Xero

Xero helps you do bookkeeping tasks faster, so you can enjoy more time doing the things that matter to you.

Xero helps you do bookkeeping tasks faster, so you can enjoy more time doing the things that matter to you.

Accept card payments with SumUp with no fixed contract or monthly fees.

iZettle is a one-stop shop for business owners to take payments, simplify day-to-day operations, and grow.

A study by CBI Insights found that running out of money was the primary reason for failure of 1 in 3 start-up businesses1 : a business that earns more than enough to cover its costs still needs to have enough money in the bank to pay suppliers when invoices are due to be paid.

With just a few steps you can keep yours healthy:

In this article we look at:

While an element of how and when you receive payments is out of your control and in the hands of your customers, there are some things that you can do to greatly improve your chances of being paid faster. Getting paid faster means more money in your account to pay your own employees and suppliers on time, and reduces the admin associated with chasing invoices. Pay particular attention to:

You may currently be managing this all by yourself. But you don’t have to. Managing your own books, sending and chasing invoices personally, and controlling the whole cash flow cycle yourself, might not be the best use of your time for your business no matter how attractive it looks in principle.

Automated accountancy software can take the legwork out of sending invoices and chasing payments. Many of the newer packages help you to turn quotes into invoices and send them instantly from your phone so you lose no time getting the invoice out. You can also set up automated payment reminders, customised accordingly so they feel personalised. By clearly outlining payment expectations from the start, automating processes and clearly communicating with your customer you increase the chances of you receiving the money faster.

Handing over your accountancy processes to a software package gives you an up-to-date accurate view of your businesses finances all from one place, allowing you to focus on running your business.

Take the legwork out of sending invoices and chasing payments with digital accounting software.

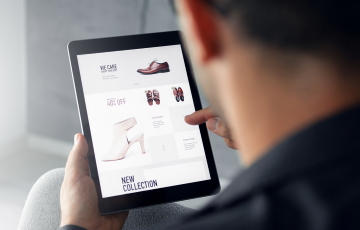

Read on for top tips on how to get up and running selling your products on online marketplaces.

There are a number of cloud-based accounting software packages that promise to be cost...

Toolkits, articles and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. See here [https://www.visa.co.uk/legal.html] for further legal conditions in relation to your use of the Visa Digital Business Kit.